It’s not enough to have life insurance. It’s important to have the correct amount for YOUR needs and goals.

Click over to our calculator to get a quick estimate of your proper coverage amount.

If you have further questions, contact us today at 248.682.7445 or owen@pkig.com

Tag: michigan

Do you need life insurance?

At PKIG, one of our main goals is to simplify insurance concepts as much as possible for our clients. There are a LOT of reasons to purchase life insurance and a LOT of different kinds of policies. It can be very confusing.

Some of these reasons are for more sophisticated concepts such as estate or retirement planning. PKIG can help with nearly any type of scenario.

That said, the key question to determine whether you need life insurance or not is would your death result in financial strain for another person? If the answer is yes in any capacity, you likely need life insurance of some sort.

You might think the process to qualify and purchase a policy is invasive and challenging but that’s not the case. In fact, you can buy a policy online without a medical exam or phone interview in just a few minutes. Just click here to try it out.

If you’re not quite ready to pull the trigger and need a more detailed consultation, please call us at (248) 682-7445 or email info@pkig.com today.

Protecting Your Business During Civil Unrest & Riots

Civil unrest can create unique challenges for Michigan businesses. Specifically, business owners face the risk of vandalism, stolen or damaged goods and extensive property damage. With this in mind, it’s crucial to take steps to mitigate the risk of potential damages to your business during periods of civil unrest.

Review the following guidance to help keep your business protected in these situations.

Stay Informed

First and foremost, make sure you stay informed via local Detroit or Grand Rapids authorities, news outlets and social media on potential events or issues that could lead to civil unrest within your community. This practice will allow you to be more aware of when civil unrest is most likely to occur and take a proactive approach to protecting your business.

Assess Property Vulnerabilities

Next, it’s important to assess your business property for potential vulnerabilities. In doing so, you will be able to better determine where to focus your mitigation efforts.

Be sure to conduct a thorough inspection of both your own property and the surrounding area—including neighboring businesses, parking lots, alleys and streets—for specific risk management issues (e.g., gaps in security measures, potential traffic or crowding concerns, the type of property at risk and concerns for employee and customer safety).

Protect Your Property

After assessing potential vulnerabilities, make sure you implement adequate security measures to help keep your business fully protected. Potential security practices to consider include:

• Utilizing security cameras

• Implementing an intruder alarm system

• Boarding up property windows and doors

• Ensuring proper locks on all windows and doors

• Installing motion-sensing external lighting and glass break sensors

• Hiring security guards

Remove Valuables

Try to remove as much cash, merchandise and high-value supplies or equipment from your property as possible. In particular, if your business utilizes a fleet of vehicles, consider moving them to a temporary, secure storage location. This way, you will be able to proactively minimize your losses in the event that your business is targeted.

Further, consider utilizing signage to communicate that money and high-value items have been removed from the premises to help deter potential thieves.

Alter Business Hours

If you suspect that that civil unrest could take place near your property, consider temporarily altering your business hours (e.g., opening or closing earlier than normal) to avoid putting your employees and customers in a dangerous situation. However, make sure you properly communicate these changes with your staff and customers to prevent any confusion. In some cases, it may make sense to temporarily close your business.

Avoid Unnecessary Conflict

In the event that civil unrest takes place while your business doors are open, it’s crucial to educate your staff on how to respond appropriately and avoid unnecessary conflict. Establish an evacuation plan that allows for employees and customers to safely leave the area during a dangerous situation. Designate specific staff to be responsible for securing the property (e.g., locking doors and boarding up windows) before evacuating.

If a potentially dangerous individual confronts any of your employees before an evacuation can occur, encourage them to react calmly and avoid using violence or responding aggressively. Designate specific staff to be responsible for contacting the local authorities or emergency services, if necessary. If the individual attempts to loot or rob your business, allow them to do so—no items are worth the risk of an employee injury or fatality.

Consult Local Authorities

Be sure to express any concerns you have regarding civil unrest in your community with local authorities—including the police department, fire department and government officials—and utilize any resources or guidance that they provide. Consider requesting additional police presence or temporary street closures near your business if you are particularly concerned about the threat of civil unrest.

Secure Proper Insurance

Apart from these loss control methods, you can ensure ultimate protection during periods of civil unrest by securing proper commercial insurance coverage. For additional risk management guidance and insurance solutions, contact PKIG today.

COVID-19 Paycheck Protection Program: What You Need To Know Now

Through the Paycheck Protection Program (PPP), the U.S. Treasury Department has established a $349 billion fund that is available to help small businesses and the millions of small business employees across Michigan and the United States. The goal is to keep as many people employed during the pandemic shutdowns as possible. The program provides forgivable loans of up to $10 million, through approved lenders, to companies with less than 500 employees.

Take Advantage Today

Any small business that affirms that “current economic uncertainty” makes the aid necessary to support their “ongoing operations” is eligible.

Aid will be given on a first-come, first-serve basis until the fund is exhausted – the application window opened on April 3rd and loans are already being disbursed, but there’s still time! It’s also possible the fund will be supplemented by further government action.

The loans are forgivable and will allow small business owners to pay for up to eight (8) weeks of payroll costs if they use the money to retain workers or hire back positions they had to cut. Other expenses like your mortgage interest, rent, and utilities are also eligible for forgiveness. Some restrictions apply so make sure to check out the resources below and confirm the terms of forgiveness with your lender. Many of the usual requirements for these loans have been cut to streamline the process. There is still quite a bit of paperwork but we think it’s more than worth it for this unique offer.

How to Get Started

You have to apply through a bank or other lender, so contact yours today and mention the Paycheck Protection Program or do an online search for their application.

If your current bank is not an eligible lender, contact a nearby eligible bank using this search tool. More key information on who can and how to apply can be found here.

Gather your documents—each lender will have their own application, but you should begin collecting records of payroll, rent, and utilities.

Here is a short video our own Christina Welch with more information.

PKIG Winter Driving Tips

Severe weather can be both frightening and dangerous for travelers. Winter storms, bad weather and sloppy road conditions are a factor in nearly half a million crashes and more than 2,000 road deaths every winter, according to research by the AAA Foundation for Traffic Safety. Drivers should know the safety rules for dealing with winter road emergencies. PKIG urges drivers to be cautious while driving in adverse weather.

PKIG & AAA recommends the following tips while driving in snowy and icy conditions:

Cold Weather Driving Tips

•Keep a bundle of cold-weather gear in your car, such as extra food and water, warm clothing, a flashlight, a glass scraper, blankets, medications, and more. Stop in to our office for a scraper or car emergency tool.

•Make certain your tires are properly inflated and have plenty of tread.

•Keep at least half a tank of fuel in your vehicle at all times.

•Never warm up a vehicle in an enclosed area, such as a garage.

•Do not use cruise control when driving on any slippery surface, such as on ice and snow.

Tips for Driving in the Snow

•Stay home if you can and only go out if necessary. Even if you can drive well in bad weather, it’s better to avoid taking unnecessary risks by venturing out.

•Drive slowly. Always adjust your speed down to account for lower traction when driving on snow or ice.

•Accelerate and decelerate slowly. Apply the gas slowly to regain traction and avoid skids. Don’t try to get moving in a hurry and take time to slow down for a stoplight. Remember: It takes longer to slow down on icy roads.

•Increase your following distance to five to six seconds. This increased margin of safety will provide the longer distance needed if you have to stop.

•Know your brakes. Whether you have anti-lock brakes or not, keep the heel of your foot on the floor and use the ball of your foot to apply firm, steady pressure on the brake pedal.

•Don’t stop if you can avoid it. There’s a big difference in the amount of inertia it takes to start moving from a full stop versus how much it takes to get moving while still rolling. If you can slow down enough to keep rolling until a traffic light changes, do it.

•Don’t power up hills. Applying extra gas on snow-covered roads will just make your wheels spin. Try to get a little inertia going before you reach the hill and let that inertia carry you to the top. As you reach the crest of the hill, reduce your speed and proceed downhill slowly.

•Don’t stop going up a hill. There’s nothing worse than trying to get moving up a hill on an icy road. Get some inertia going on a flat roadway before you take on the hill.

Tips for Long-Distance Winter Trips

•Be Prepared: Have your vehicle checked by a AAA Approved Auto Repair facility before hitting the road.

•Check the Weather: Check the weather along your route and when possible, delay your trip if bad weather is expected.

•Stay Connected: Before hitting the road, notify others and let them know your route, destination and estimated time of arrival.

If you get stuck in the snow:

•Stay with your vehicle: Your vehicle provides temporary shelter and makes it easier for rescuers to locate you. Do not try to walk in a severe storm. It is easy to lose sight of your vehicle in blowing snow and become lost.

•Don’t over exert yourself: When digging out your vehicle, listen to your body and stop if you become tired.

•Be Visible: Tie a brightly colored cloth to the antenna of your vehicle or place a cloth at the top of a rolled up window to signal distress. At night, keep the dome light on if possible. It only uses a small amount of electricity and will make it easier for rescuers to find you.

•Clear the Exhaust Pipe: Make sure the exhaust pipe is not clogged with snow, ice or mud. A blocked exhaust pipe can cause deadly carbon monoxide gas to leak into the passenger compartment of the vehicle while the engine is running.

•Stay Warm: Use whatever is available to insulate your body from the cold. This could include floor mats, newspapers or paper maps. Pre-pack blankets and heavy clothing to use in case of an emergency.

•Conserve Fuel: If possible, only run the engine and heater long enough to remove the chill. This will help to conserve fuel.

Michigan Auto Insurance Reform Update

Some Michigan auto insurance reform changes have already gone into effect. Others start in July 2020. With so many drivers unaware of the impact of the new law on their current car insurance policy, now is the time to review coverage. To help identify potential coverage gaps, please consider these questions:

• Are there drivers listed on your policy that do not reside with the named insured?

• Are there residents in the home that are not family members?

• Are there resident family members of driving age that are not listed on your policy?

• Is any vehicle on the policy owned by someone other than the named insured(s), spouse or resident family member?

• Does any driver not listed on the policy have regular use of one of the vehicles?

• Are any vehicles used for business purposes such as Uber or Lyft?

If the answer to any of these questions is “yes,” your existing policy may have a gap in coverage and needs to be reviewed immediately. Please call us at 248-682-7445 to begin your policy review today.

Michigan’s Overhauled No-Fault Insurance Laws Take Effect July 1, 2020

On May 30, 2019, Michigan Gov. Gretchen Whitmer signed into law a bill that will bring sweeping changes to the state’s no-fault auto insurance laws. The primary goal of the new legislation is to reduce auto insurance premiums, as Michigan has some of the highest auto insurance rates in the nation.

Though the new legislation provides numerous changes to the auto insurance industry in Michigan, the following are the key takeaways:

•Drivers will no longer be required to purchase unlimited no-fault personal injury protection (PIP) benefits, which guarantee lifetime medical benefits for catastrophic crash injuries. After July 1, 2020, and through July 1, 2028, drivers may select their own no-fault PIP coverage. Under the new law, drivers may choose between $50,000 coverage (if enrolled in Medicaid or Medicare), $250,000 coverage, $500,000 coverage or unlimited PIP coverage.

•Once the new legislation takes effect, drivers could enjoy an auto insurance premium cost reduction depending on which PIP coverage they select. Note that all savings are limited only to the no-fault portion of a driver’s auto insurance bill (typically around 40% of the total premium), not the entire bill. Furthermore, the legislation does not address what the insurance providers may charge on other portions of insurance bills.

•A no-fault fee schedule was established to regulate the rates charged by medical care providers (e.g., doctors and hospitals) regarding medical care associated with auto accidents. Note that the fee schedule will not apply for the entirety of the first year the law is in effect.

•Drivers who choose any PIP coverage lower than unlimited will pay reduced fees to the Michigan Catastrophic Claims Association (MCCA), an entity that bears responsibility to pay catastrophic injury benefits.

•Insurance providers will be prohibited from considering “non-driving factors” when determining insurance rates. Those factors typically include sex, marital status, educational level and occupation. However, providers can still set rates based on “territories” of the state. For example, providers could set higher rates for those who live in a region in which there are heightened instances of accidents or car thefts.

We will continue to provide information as it becomes available.

Please contact us at (248) 682-7445 or info@philkleininsurance.com for more information.

Don’t Make These Mistakes

Is Your Employer-Provided Life Insurance Coverage Enough?

Is the life insurance you’re getting through your employer enough to take care of your family? And are you paying too much for that coverage? A healthy 50-year-old male could save nearly 80% on premiums in the first year alone by switching from an employer-provided term life insurance policy to an individual one, according to the National Association of Financial Planners. Young, healthy employees might also be better off with individual coverage, since they can lock in low rates for decades.

But many companies pay for some amount of life insurance for their workers; they also allow workers to purchase more coverage for themselves and their spouses at a low cost and with no medical exam. As a result, many families obtain all of their life insurance through an employer. If you make $75,000 per year, your employer might provide $75,000 or $150,000 in coverage at little or no out-of-pocket cost to you, and the premiums will come straight out of your paycheck. This way, you’ll never miss the money or worry about paying the bill. And even if you’ve had less-than-perfect health, you’ll qualify for just as much coverage as your co-workers. That all sounds enticing, but there are several potential problems with obtaining life insurance through work.

Problem 1: Your Employer May Not Offer Enough Life Insurance

While basic employer-provided life insurance is low-cost or free, and you may be able to buy additional coverage at low rates, your policy’s face value still may not be high enough. If your premature death would be a financial burden to your spouse and/or children, you probably need coverage worth five to eight times your annual salary. Some experts even recommend getting coverage worth 10 to 12 times your annual salary. PKIG can help determine how much you need based on your goals.

Another shortcoming? Salary doesn’t take into account bonuses, commissions, other sources of income, and the value of other benefits such as medical insurance and retirement contributions.

Your employer’s group life insurance might be sufficient if you’re single or if you have a spouse who isn’t dependent on your income to cover household expenses and you don’t have children. But if you’re in this situation, you might not need life insurance at all.

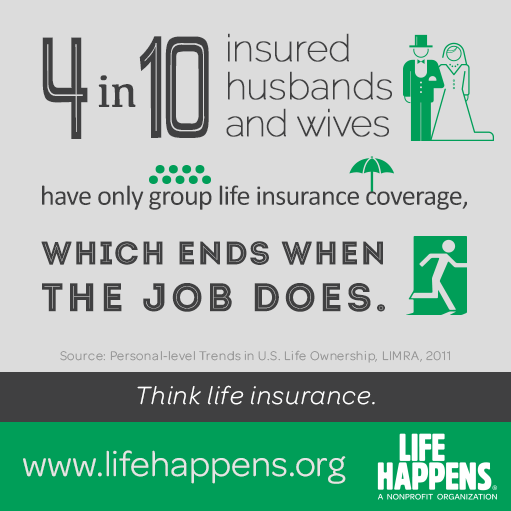

Problem 2: You’ll Lose Your Coverage If Your Job Situation Changes

As with health insurance, you don’t want gaps in your life insurance coverage because you never know when you might need it. Most workers who get coverage through work don’t know where their life insurance will come from if they change jobs, are laid off, their employer goes out of business or they switch from full-time to part-time status. You usually won’t be able to keep your policy in these scenarios. Lack of portability can be a problem if you aren’t going directly to another job with similar coverage and aren’t healthy enough to qualify for an individual policy. Some policies do allow you to convert your group policy to an individual one, but it will likely become much more expensive. If you’re losing your coverage because you were laid off, the premiums might be unaffordable.

Problem 3: Coverage Gets Tricky If Your Health Declines

Another problem arises if you’re leaving your job because of a health problem. If a medical condition forces you to leave your job, it’s unlikely that you would be able to qualify for life insurance at that time. Needless to say, that’s the time your family would need the coverage most.

Even if your health problems aren’t significant enough to stop you from working, they might limit your employment options if you only have life insurance through work.

Problem 4: Your Plan Doesn’t Provide Enough Coverage for Your Spouse

While your employer’s benefits package probably provides health insurance for your spouse, it won’t always provide life insurance for him or her. If it does, the coverage may be minimal—$100,000 is a common amount, and that doesn’t go far when you lose your husband or wife unexpectedly.

Couples often assume the family will only suffer economic hardship if the primary breadwinner dies and many workers fail to adequately insure their spouses. The death of a non-working or lower-earning spouse can certainly impact their partner’s income. You probably aren’t going back to work on Monday if you lose your spouse over the weekend. How much paid time off do you have to cover an extended leave? Plus, you must now pick up the slack with day care or carpooling – hours can be cut back – there won’t be enough time to properly grieve and survivors are often depressed which lowers productivity.

Problem 5: Employer-Provided Life Insurance May Not Be Your Cheapest Option

Even if you can get all the life insurance you need for both you and your spouse through your employer, it’s a good idea to shop around to see if your employer’s supplemental insurance really offers the best value for the money. You’re more likely to find a better rate elsewhere the younger and healthier you are. Also, unlike the guaranteed level-premium life insurance you can purchase individually, which costs you the same amount every year for as long as you have the policy, the policy provided by your employer tends to get more expensive as you age.

Employer provided coverage tends to increase in price after age 35 and typically increases every year or five years. Once you reach age 50 the policy can often become much more expensive and usually unaffordable closer to retirement age.

The Solution

While there’s no reason not to take advantage of any free or inexpensive insurance your employer offers, it probably shouldn’t be your only source of life insurance, nor should most people rely heavily on the supplemental life insurance they can get through work. The solution to each of the problems described above is to purchase some or all of your life insurance directly through an individual term policy. You might need to purchase as much as 80% of your life insurance on your own to have enough and to make sure you’re covered at all times and under all circumstances.

If you don’t think you qualify for individual life insurance, it’s important to actually find out. Underwriting standards have changed considerably over the past ten years or so. Also, if you work with an Independent Agency like PKIG your chances of approval will be dramatically higher. Captive insurers such as State Farm or Allstate typically have much stricter underwriting standards which lead to higher premiums and more frequent declinations on average. The most affordable solution is to buy the most insurance you can afford at the youngest age, since, as you age, the chance of acquiring an illness goes up, and with illness comes more expensive premiums, if you can qualify at all.

The Bottom Line

You need enough life insurance to cover all your debts and support your dependents. “Enough” includes paying off your credit cards, car loans and mortgage, paying for your children’s education, and making sure your spouse will have the financial means to take care of him or herself and your children. In a time of grief, the last thing you want is to leave your loved ones with another major life upheaval such as having to change jobs or schools because of financial strain, so take a close look at whether the life insurance you’re getting through work is the best way to provide for your loved ones.

Get instant quotes on top-rated life insurance coverage here in less than 30 seconds or call (248) 682-7445 for more information today.

The Ins and Outs of General Liability Coverage: What’s Covered – And What’s Not

As a small business owner, you have a lot on your plate. From accounting, to marketing and sales, to product development and inventory — the to-do list can seem never ending. That’s why it’s no surprise that details like liability insurance can so easily slip through the cracks, leaving your business financially vulnerable.

Unfortunately, nearly anyone your business interacts with can make claims against you. And without the right insurance protection, these claims could cripple your operation.

What General Liability Insurance Covers

General liability (GL) coverage can be part of a standalone policy or can be part of a business owner’s policy (BOP). This coverage safeguards your business’ finances and reputation in the event a customer or third party takes legal action against you or your employees.

The following are types of claims covered by a GL policy:

Bodily injury: If a third party is injured at your place of business (or as a result of work performed away from your business), your GL policy would cover costs, including medical expenses, lost wages, and any court-awarded compensation or out-of-court settlements.

Property: If your business’s actions result in damage to someone else’s property, your GL policy will cover costs to repair the damage. This applies to real estate, equipment, and supplies, as well as compensation for loss of use during the time it takes for the damaged property to be repaired or replaced.

Personal and advertising injury: If your business causes nonphysical damage to a third party through advertising tactics or other activities, your GL policy will cover these damages. However, coverage does not apply if your business intentionally makes a false statement knowing it will cause harm.

Additionally, if a lawsuit is filed against your business for a covered loss, your GL policy will also cover the legal costs to defend you in addition to your policy limits, including attorney fees and court costs.

GL coverage safeguards your business’s finances and reputation in the event a customer or third party takes legal action against you or your employees.

What General Liability Insurance Doesn’t Cover

GL coverage does have limits — both in dollar amounts and types of situations covered. This depends on a number of factors, including your specific industry and your business’s exposure to visitors and clients.

However, there are a few limits that apply to businesses across the board. GL does not cover the following types of damages:

Workplace injuries: GL normally doesn’t cover workplace injuries to employees. Instead, you’ll need workers compensation coverage, which is legally required by most states.

Damage to your own property: GL covers damages to other parties’ property, but it doesn’t cover your business’s property. Instead, you’ll need a business owner’s, inland marine, or commercial property policy.

Intentional damage: Damage done purposefully or maliciously is not covered under a GL policy.

Damage to client property in your care: GL does not cover damage to a customer’s property while it is in your care. Inland marine and other property coverages can provide this type of protection.

Professional mistakes: Mistakes resulting in a loss aren’t covered by GL. For instance, if your business misprints 10,000 books, general liability coverage won’t reimburse you for the cost of reprints. However, many insurers offer separate policies for businesses that require professional liability protection.

Damage to vehicles: This protection requires a commercial auto policy.

While general liability insurance won’t cover every incident and expense your business might face, it can protect your business from claims brought against you by third parties — and it’s a relatively inexpensive way to create peace of mind.

Contact us today at (248) 682-7445 or info@philkleininsurance.com for more information.